ICT Insight™

📘 Case Study #2 – ICT Insight™ #

🗓️ Date: 06/05/2025

💱 Pair: BTCUSDT.P

⏱️ Timeframe(s): 15m (context), 1m (entry)

📈 Trade Type: Long

🧠 Concepts used: IBDR, SMT, BPR

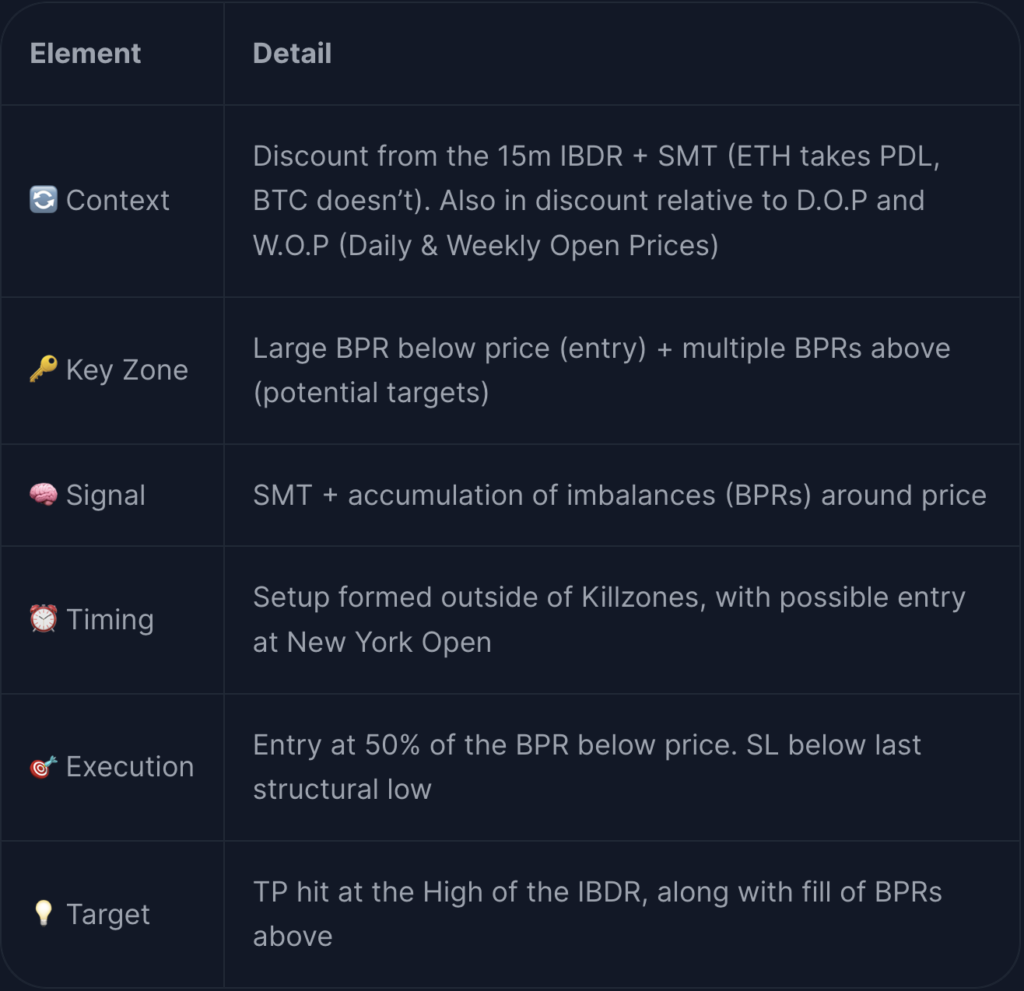

In this second case study, we’ll analyze a long trade based exclusively on the concepts of SMT, IBDR, and BPR.

This scenario intentionally excludes other common concepts (PO3, STD, FVG, Killzones…) to present a cleaner, more minimalistic approach, which remains highly effective when strong confluence is present.

This trade is featured as a short on our YouTube channel. Below, we break down each step with simple explanations and annotated charts.

🔍 Step 1 – Clean and simple context #

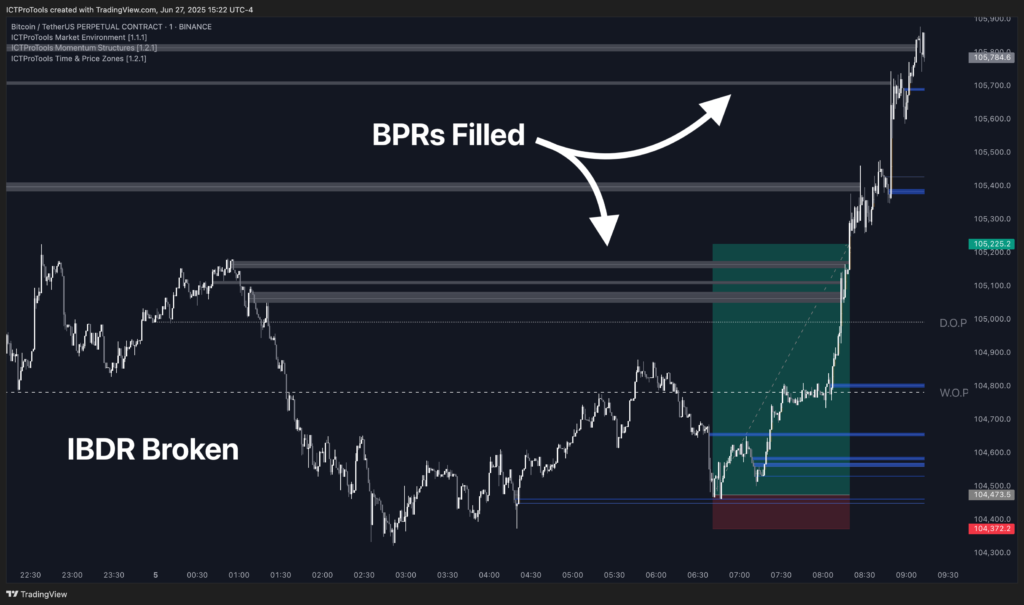

We observe BTC on the 15m chart, evolving within its IBDR (intraday balance).

The price oscillates around the equilibrium and returns to the Discount zone of the IBDR.

At the same time, an SMT (Smart Money Tool) is detected:

→ ETHUSD takes its PDL (Previous Day Low), but BTC doesn’t, making BTC the stronger asset.

This SMT signal creates a clear bullish bias for a return to the equilibrium or the High of the IBDR.

Additionally, the D.O.P (Daily Open Price) and W.O.P (Weekly Open Price) are also located above price at the time of analysis.

This confirms that we are not only in the discount of the IBDR, but also in the discount relative to the weekly and daily opens, further reinforcing the bullish bias.

📍 Step 2 – Presence of BPRs (Balanced Price Ranges) #

ELooking at the structure, several BPRs are clearly visible:

- A large BPR below price, used as our entry zone

- Several BPRs above price, acting as potential targets to fill

This cluster of BPRs serves as a map of institutional imbalances and gives us a clear idea of what price might aim to reach next.

🎯 Step 3 – Entry, SL and TP #

Our entry is placed at 50% of the largest BPR located below price.

The Stop Loss is set below the last structural low.

Take Profit is placed at the High of the IBDR, which coincides with the filling of multiple BPRs.

Here, the High of the IBDR acts like a liquidity magnet, strengthened by surrounding imbalances.

✅ Step 4 – Trade outcome #

After triggering the entry on the BPR, price moves up.

It reaches the High of the IBDR (TP hit), and continues even higher, filling other BPRs located above.

Partial management with scale-out exits would also have been possible here.

📊 Setup Recap #