ICT Insight™

📘 Case Study #1 – ICT Insight™ #

In this first case study, we’ll thoroughly analyze a long (buy) trade based on ICT concepts, implemented through our ICT Insight™ indicators.

This trade is featured in our first YouTube video (📺 watch the video), and we’ll walk through each step here with annotated screenshots and simple explanations.

🔍 Step 1 – Context on the Analysis Timeframe (10m) #

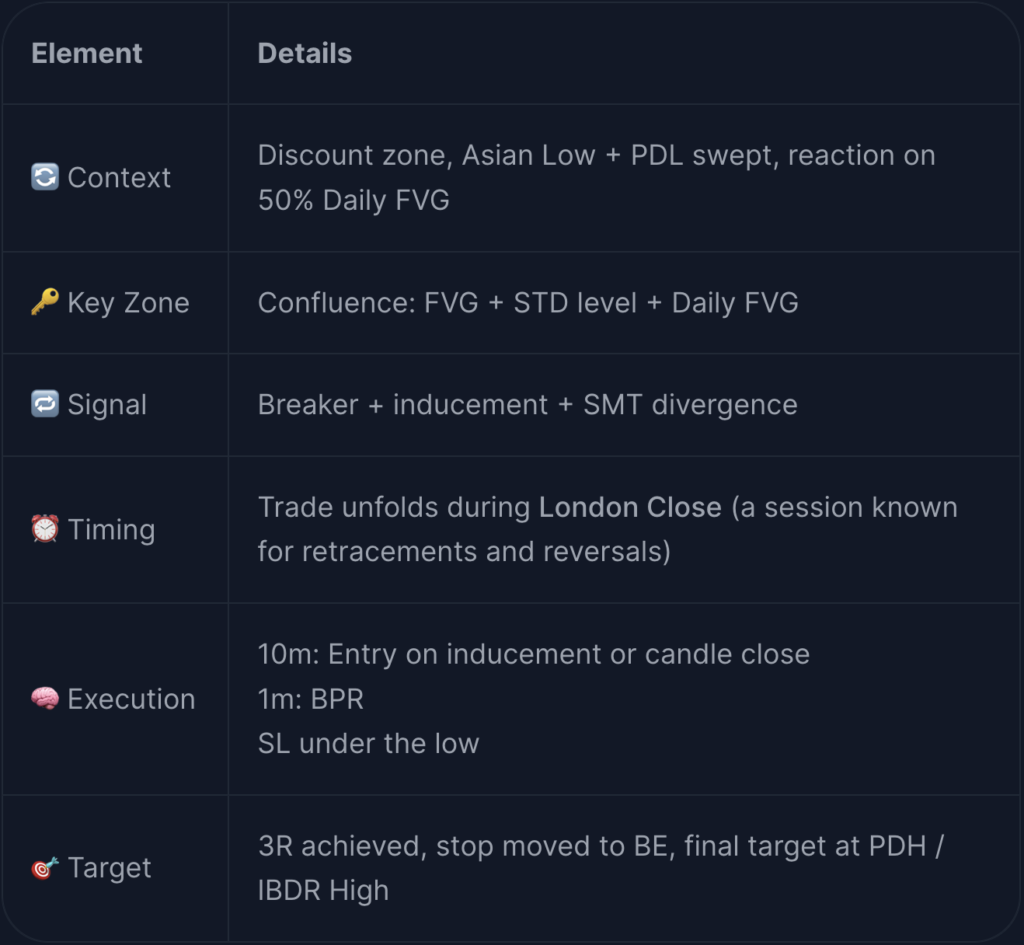

We begin the analysis on EURUSD, using the 10m timeframe as our main view.

We observe the following:

- The Asian Session Low has been swept

- The PDL (Previous Day Low) has also been taken

- Price is currently trading below the 1h IBDR equilibrium, meaning we’re in a Discount environment

- And finally, based on the PO3 Daily Candles, price is reacting to a Daily FVG, not far from its 50% level

These factors suggest a potential bullish reversal, but further confirmation is needed.

📍 Step 2 – Reaction on a Key Zone (multiple confluences) #

Price drops again and this time:

- Reacts precisely at the 50% level of the Daily FVG

- Hits the 4th lower level of the STD module (Standard Deviation, based on a consolidation between 1 PM and 11 PM NY time)

- Fills a large portion of a previous M10 FVG caused by the last impulsive move

👉 This triple confluence (HTF imbalance + STD duplication + local FVG) strongly suggests a potential day low is in place.

We now enter the confirmation phase.

📈 Step 3 – Reversal Signal & Entry #

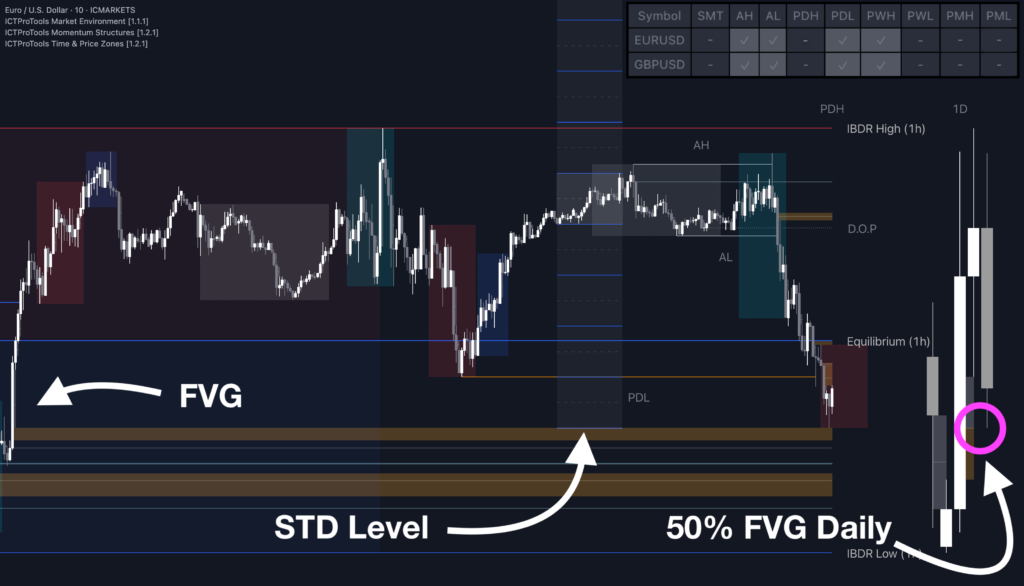

At this point, several elements suggest a reversal is underway:

- Price reacts to the confluence of FVG + STD + Daily FVG

- It forms a breaker (clear shift in market structure)

💡 (If you have trouble spotting these structure breaks or want to detect them faster, feel free to use our free indicator “ICT Breakers (BOS / MSS – Market Structure)” on TradingView. It automatically highlights BOS and MSS for you.)

- An inducement (a liquidity swing just before the move) is also created

- Most importantly, we see an SMT divergence: → GBPUSD sweeps its PWL, but EURUSD does not, indicating EURUSD is relatively stronger

We now have all the ingredients for a potential entry.

⏰ Important note:

This trade is prepared during the New York session and unfolds during the London Close session, a time well-known for triggering retracements and reversals, especially after strong expansions like the one observed here.

This timing adds even more confidence to the likelihood of a bullish move.

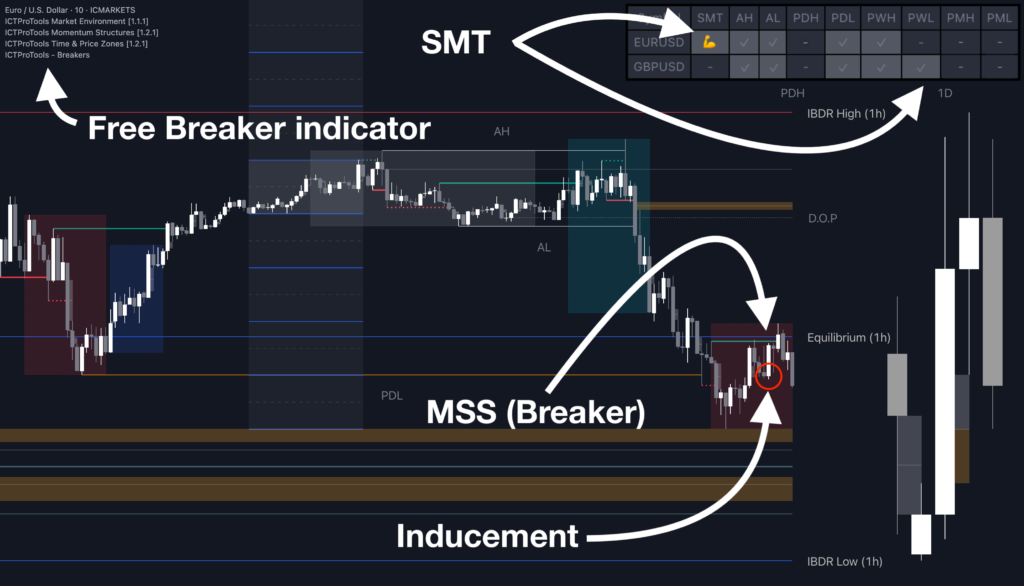

🎯 Two Entry Options:

Option 1 – Safer Entry (great for beginners) #

- Stop loss placed below the recent low (STD reaction)

- Entry on the inducement or at the candle close

Option 2 – Advanced Entry on LTF (1m) #

For more experienced traders looking for precision:

- Just below, a BPR (overlapping FVGs) forms

- The same breaker structure is visible on 1m

- Followed by a clear inducement

🎯 You can enter:

- On the BPR, with a SL below the swing low beneath it

- Or on the inducement on 10m, for those staying on the analysis timeframe

⚠️ Note: A trade taken on the 1m BPR offers a better risk/reward, but it’s also more exposed to fake-outs.

It therefore requires more experience and execution precision to avoid getting trapped.

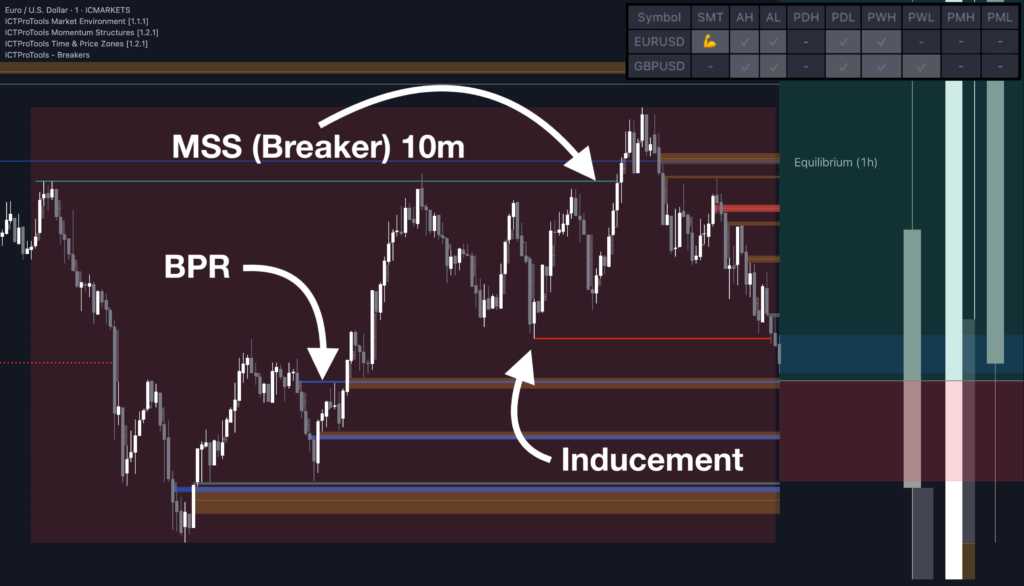

🎯 Step 4 – Trade Outcome & Management #

After entry:

- Price accelerates quickly

- Reaches a 3R target, allowing the stop to be moved to break even

- Then continues higher, reaching a key liquidity area (Equal Highs, FVG, or IBDR High)

🎯 In this specific case, the target was the High of the 1h IBDR, which also aligned with the PDH (Previous Day High) — a perfect level to close the trade.

✅ Setup Summary #